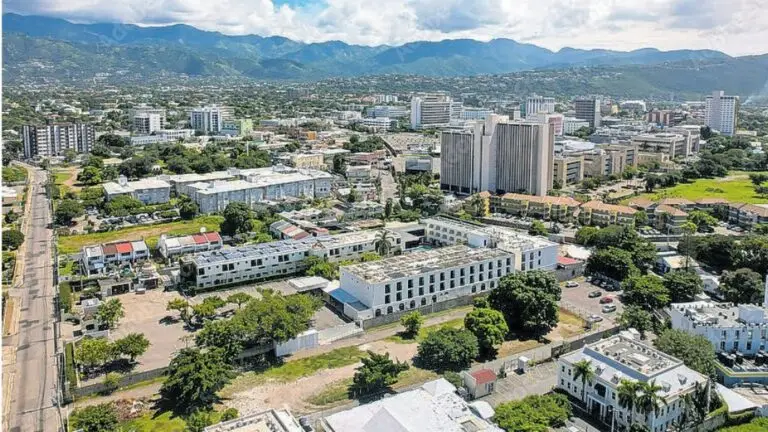

KINGSTON, JAMAICA —

Appearing on the latest episode of Algo’s Podcast, Renozan Limited’s President Sadeeke McGregor offered a firm assessment of what he described as “an infrastructural reshuffling” of payments across Jamaica, and the Caribbean at large — one that is gradually phasing out the ATM as a primary tool of consumer finance.

Speaking on the evolution of money movement, McGregor noted that ATM withdrawals have fallen year over year, not just in frequency, but in value — a signal that the traditional cash-first model is weakening under the rise of embedded, real-time payment systems.

“The ATM is losing its purpose,” McGregor said. “We are watching a payment instrument fade — not because people don’t want cash, but because POS systems are now integrated into trade.”

McGregor’s remarks aligned with data recently published by the Bank of Jamaica, showing that in the first half of 2025:

- ATM withdrawal volumes fell from 25.14M to 24.77M

- Total value withdrawn declined by J$51.7 billion, from $470.6B to $418.9B

In contrast, POS transactions — referring to card payments at merchant terminals — rose by 3.7 million in volume, and moved J$662.5 billion in value, up from $610.7 billion over the same period in 2024.

“The numbers are confirming what providers have known for some time,” McGregor said.

“Card Payments are no longer an optional channel — it is the dominant layer through which money now flows.”

While the conversation touched on consumer behavior and economic access, McGregor gave special attention to the role of POS Software Providers, many of whom operate across multiple Caribbean countries.

Long confined in the Caribbean to inventory and receipt systems, these developers are increasingly being drawn into the financial core, as payment integration becomes essential to merchant operations.

They’re not just software vendors anymore, McGregor observed. They’re becoming custodians of the flow.”

McGregor also raised the critical point often overlooked in discussions about retail payments: what should be a single retail system — combining inventory software and card machine infrastructure — is treated as two entirely separate components.

In most global markets, both are handled by the same provider. In the Caribbean, however, banks have traditionally held a tight grip on card machine infrastructure, leaving actual POS providers — the ones responsible for software, receipts, inventory, and the customer experience — cut off from the payments layer.

The fact that POS providers still can’t fully access the flow of payment shows how backwards the system is,” McGregor said. “They’re doing 60% of the job; we’ve allowed them that other 40%”

Renozan’s role is to empower the POS side — giving these providers direct access to the card-present layer so they can access the full experience: from inventory to checkout to payment settlement.

In at least nine Caribbean markets, Renozan is helping bridge this disconnect by:

- Giving POS providers’ enablement to in-store card payments

- Merging payment flow into POS-led inventory systems

- Powering self-checkout and cashier automation

- Direct access to all local banks to ensure flexible settlements, & resilient payment processing

Throughout the interview, McGregor resisted calling the change disruptive. Instead, he described it as a structural repositioning — one where the machinery of finance is being relocated to the systems merchants already use daily.

“We’re merely coupling what have always been two parts of the same whole.”

He made it clear that the shift isn’t about new tools, but about aligning payments with the realities of trade — and in that realignment, developers of merchant-facing systems may find themselves with a role more central than ever before.

McGregor concluded the segment by noting that while policy conversations often center on banks, fintechs, and consumer access, the POS — and the software behind it — is increasingly where the economy touches the individual.

“We don’t talk about POS much,” he said. “But we should. They’ve become the meeting point of trade, trust, and transaction.”