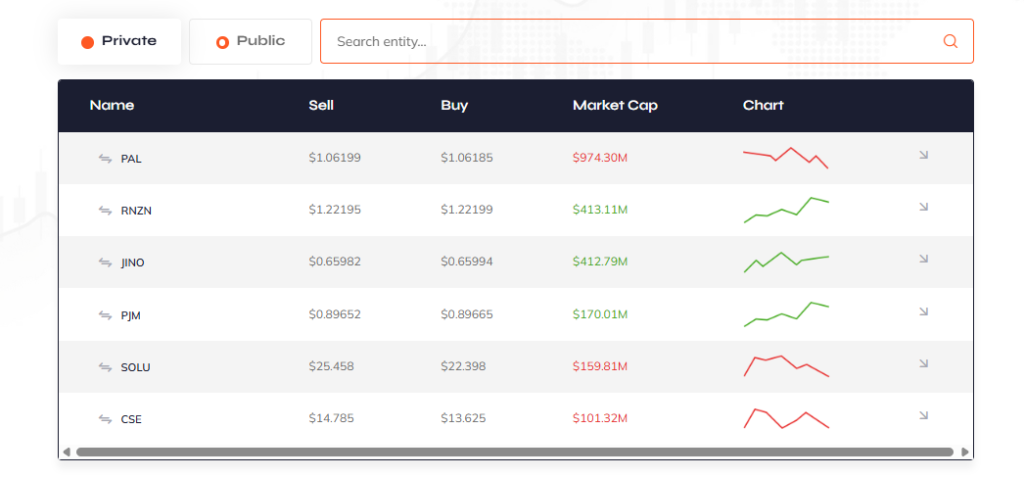

Against a backdrop of fierce competition, regulatory scrutiny, and industry turbulence, Renozan Limited (RNZN) has surged to become the second most valuable private company in Jamaica’s financial and technology sectors — a climb many analysts are calling nothing short of unstoppable.

Led by 21-year-old President Sadeeke McGregor, Renozan’s resilience in the face of legal skirmishes and public criticism has turned heads across the Caribbean. With its valuation soaring and market influence deepening, RNZN is no longer a scrappy fintech upstart — it’s a private-market titan, and one that legacy institutions are scrambling to contain.

At a closed-door industry event last Friday, McGregor, known for his sharp wit as much as his sharp strategy, addressed the rumors swirling around a potential IPO.

I hear the whispers,” he joked, smiling at a crowd of executives and investors.

“Maybe we’ll go public one day… just to make it harder for them to sleep.

The comment, while delivered in jest, sent a wave of speculation through financial circles. Industry observers note that if RNZN were to go public, it would immediately become one of the most-watched tech listings in Caribbean history.

McGregor’s meteoric rise has not gone unnoticed by political and business leaders alike.

Several prominent public figures have publicly praised his vision and execution, calling him “a once-in-a-generation architect” of modern financial infrastructure.

One government official, speaking at a national economic forum, remarked:

While others talk about innovation, McGregor builds it. He isn’t just participating in the economy — he’s designing the next one.

Business chambers across the region have also lauded RNZN’s impact on lowering merchant transaction costs, improving small business access to credit, and pushing the traditional banking sector to innovate faster.

RNZN’s climb has not been without controversy. Amid a backdrop of shareholder disputes, competitor pushback, and legal maneuvers, the company has remained laser-focused on execution.

- The Renozan Terminal continues expanding across supermarkets, pharmacies, restaurants, and gas stations island-wide.

- Digital loans, debit and credit cards, and insurance products have rolled out to a growing merchant base eager for faster, cheaper financial solutions.

- Transaction volumes are on track to surpass US$2 billion by 2025, solidifying RNZN’s stronghold over the Caribbean’s digital finance landscape.

In an era where headlines are often dominated by volatility and setbacks, RNZN’s relentless forward motion stands as an anomaly — and a warning to competitors.

For now, McGregor appears in no rush to bring RNZN onto the public markets.

Privately, insiders suggest that the company is still aggressively consolidating key sectors before considering a listing.

But with public enthusiasm mounting — and RNZN’s valuation surging — the question isn’t if Renozan will go public.

It’s when.

And when it does, it may very well redefine the Caribbean’s financial market landscape for decades to come.