KINGSTON, JAMAICA — As cash becomes less common across the country, and more Jamaicans turn to cards and digital wallets for everyday spending, Jamaica’s largest financial institutions are quietly shifting focus—moving deeper into the systems and services that support businesses at the point of payment.

JMMB Bank, National Commercial Bank, First Global Bank, Renozan Financial Limited, Sagicor Bank, and JN Bank are among the institutions making assertive moves to expand their merchant payment strategies heading into the next decade. They represent a segment of a broader national shift, as ATM withdrawal volumes decline and digital transaction behavior becomes standard across all tiers of commerce.

Institutional Activity Gathers Pace

JMMB Bank has taken a more concentrated approach, focusing on outfitting professional offices, small hospitality businesses, and health service providers with modern card acceptance tools—particularly in environments where check and cash were dominant.

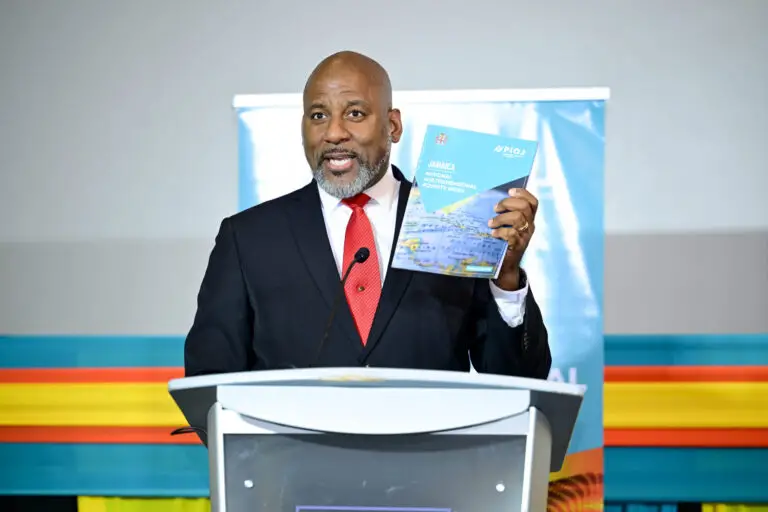

National Commercial Bank (NCB) has doubled down on its Tap to Pay Android rollout, targeting even micro-merchants and street-side vendors. By embedding payment functionality into affordable mobile devices, NCB is attempting to widen its grip from chain stores to curbside operators.

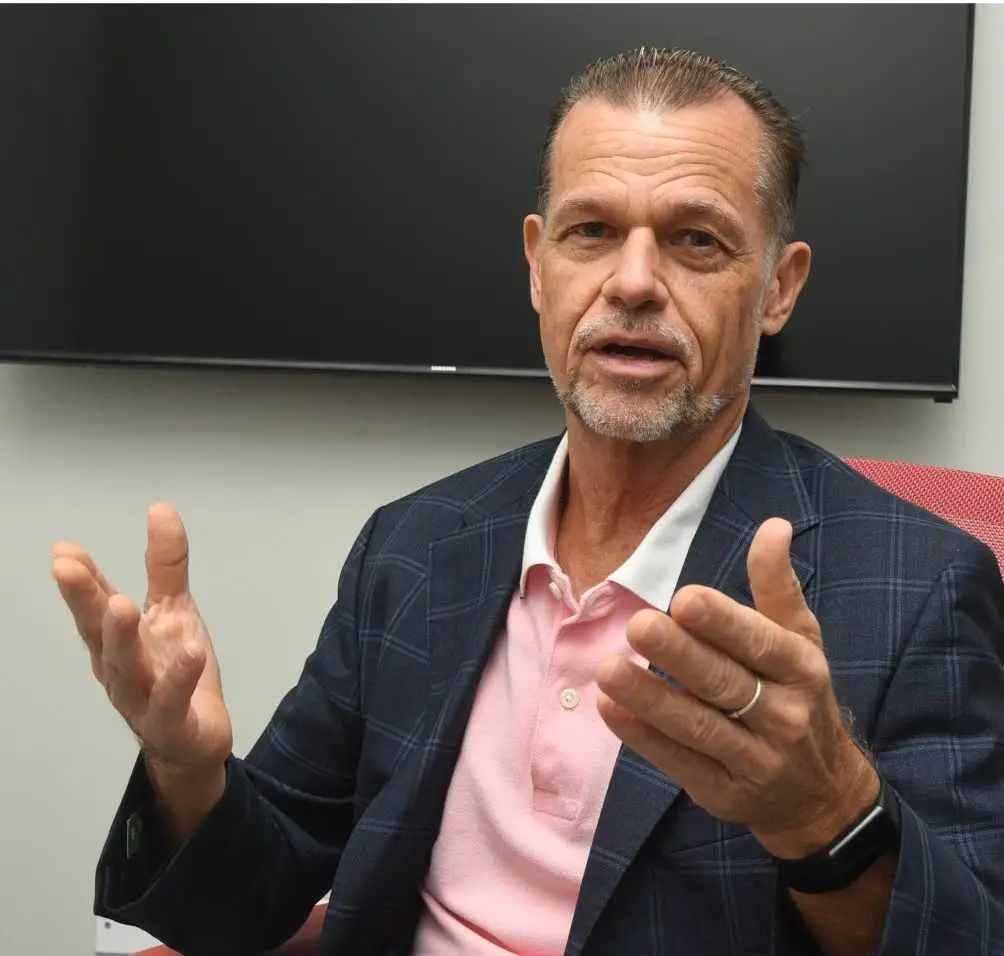

First Global Bank has re-entered the merchant payments sector following a period of absence. With upgraded infrastructure and a strategy centered on partnerships, the institution has begun positioning itself for a return to competitiveness, aiming to regain ground through fast deployment and alignment with key merchant networks.

Renozan Financial Limited has opened settlement connections to all local banks, offering a consistent cost model and backend support to less dominant institutions in the payment space—such as First Global Bank and Cornerstone Merchant Bank, to name a few—as well as retail operators aiming to cement their own merchant-facing solutions.

Sagicor Bank has deepened its merchant efforts by expanding card machine availability across established pharmacy and retail partners, while launching targeted deployments in food marts and fast-casual outlets. The bank has also begun tailoring support toward high-traffic franchises migrating from manual checkout systems.

JN Bank continues to scale its payment infrastructure through the rollout of JN Pay and other merchant-facing offerings. The institution is prioritizing tap-to-pay readiness and increased device availability in community businesses, salons, restaurants, and convenience retail.

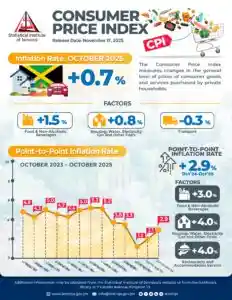

ATM usage has dropped steadily over the past two years, with the latest industry data showing continued movement away from cash handling. More merchants, especially in the retail, pharmacy, and food sectors, are adopting digital payment solutions to meet customer demand.

As this shift continues, banks and authorized payment providers are moving to secure their position—not only by offering payment tools, but by anchoring their presence in everyday business activity.

The merchant layer is now seen as a long-term growth area for institutions aiming to remain relevant as spending habits evolve.

With digital currency frameworks being explored at the policy level and new technologies shaping daily transactions, financial institutions are expected to continue building partnerships and expanding reach within the merchant economy throughout 2026 and beyond.

Further updates are expected in the months ahead.